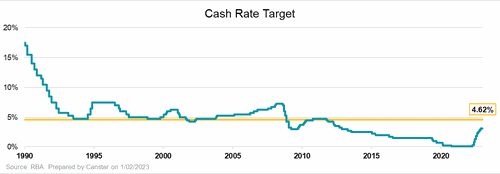

Canstar analysis shows the historical average cash rate (that is, the average interest rate since 1990) is 4.6 per cent which is a full 1.5 per cent higher than the current 10-year high of 3.1 per cent.

Using the historical average as a guide means more rate pain may be on the way.

As a result, Canstar forecasts up to six more 0.25 per cent rate rises could be on the horizon.

A 1.5 per cent hike to the current rate would add an extra $498 to monthly repayments for a $500,000 loan.

Over the past year, borrowers have been stung by $1386 added to their repayments.

The continual rate hikes come as the Reserve Bank of Australia tries to slow surging inflation, which hit 7.8 per cent in the December quarter, and shows no sign of weakening.

“The Reserve Bank keeps reminding us that its cash rate decisions are all based on the data, and the December quarter inflation increase of 1.9 per cent and annual rate 7.8 per cent won’t be enough to change the Bank’s course,” Canstar finance expert Steve Mickenbecker said.

“More rate rises look inevitable.”

The average cash rate takes in the economic turmoil of the 1990 recession when interest rates hit 17.5 per cent through to 2020 which saw an all-time low of 0.10 per cent.

“Nonetheless, an average over a 33-year period gives some indication about what is at least normal, and that is a cash rate of 4.6 per cent,” Mickenbecker said.

Read Related Also: Pentagon releases U2 pilot's cockpit picture of Beijing's surveillance craft as it flew over US

“Before 2009, the cash rate had never been below 4.25 per cent, and it only hit subsequent lows in response to the Global Financial Crisis.”

It comes amid growing concerns 2023 could be the year of the recession as global economies also battle skyrocketing inflation by tightening the cash rate.

But Australia might be in the clear of a devastating recession in 2023 and Mickenbecker claims the central bank may take its foot off the pedal on interest rate hikes temporarily after two or three more hikes.

“But history tells us that any pause might be a breather and not necessarily a signal of imminent lower rates,” he warned.

In the wake of the tumultuous rate news, Mickenbecker has recommended borrowers look into as low a priced loan as possible.

“Even if times don’t get tougher, they’ll be better off,” he said.

“Refinancing from an average variable rate of 5.98 per cent to the lowest rate of 3.99 percent for a $500,000 loan over 30 years will save $607 per month.

“That’s close to eight 0.25 percent rate increases, which takes away some of the pain.”

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.