Loraine Carpenter should be getting ready to settle into a comfortable retirement, having worked hard over the years to build up her own business.

Instead, the 75-year-old from Brisbane says she is now looking to move overseas because she can no longer afford to live in Australia.

Up until last year, Carpenter had a sizeable nest egg to fall back on.

The nightmare began for Carpenter in September 2022 when she was searching for somewhere to invest that nest egg.

“I had $700,000 because I had just sold my mother’s house and my house,” she told 9news.com.au.

At the time, interest rates were at rock bottom, and term deposits were offering very little in the way of returns.

Carpenter said it was a dodgy celebrity deepfake advertisement on Facebook that caught her attention.

“I think the one I saw was (tennis player) Ash Barty, but they were rife at the time,” Carpenter said.

Carpenter followed a link from the ad, which directed her to a website where she was told to pay a deposit of $US250 to begin investing with TBX Titanium (also known as the Exchange Bank), which billed itself as an online broker of cryptocurrencies.

Not long after, a man with an American accent called her.

“His name was Mike and he told me he was in a trading room. It was very noisy and all the voices in the background had American accents,” Carpenter said.

Carpenter said she was reassured that the bank account she was told to transfer her investments into was an Australian one, at Bendigo Bank.

However, an investigation by the NSW Police Cybercrime Squad and the St George Area Command later revealed the woman who set up the account had been used as a mule.

Police discovered the woman had responded to a job ad on Facebook from a fake UK employment agency, who requested she open up the bank account and register the business.

Carpenter said she did a search online about the Exchange Bank and only saw positive reviews.

She began making weekly, and sometimes even bi-weekly, deposits of $25,000 into the Bendigo Bank account.

Carpenter said her bank, ANZ, made a call to her after the first withdrawal to check the transaction.

“They phoned up and said there is a big chunk of money going out. And I said yes, I authorised that. They didn’t ask again.”

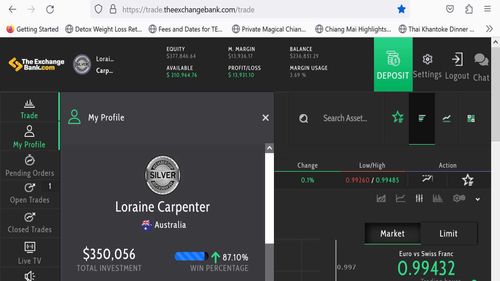

To see her investments, Carpenter was directed to a fake website, which showed an elaborate, but bogus trading platform.

There were market surges and falls.

At one point, Carpenter said her investment plunged $US17,000 ($27,000) overnight.

“That reassured me, actually, that the whole thing was operating as a trading platform should,” Carpenter said.

Carpenter said the man she was speaking with would also reassure her that the money was in safe hands.

“I quite often said to him, ‘I’m playing with a big chunk of my money here.'”

“Towards the end, I said, ‘We are now playing with my house.’ And he said, ‘Look, it’s all fine.'”

Wanting to split the risk of her investments, Carpenter said she requested $US150,000 be transferred into a bonafide Exodus wallet, and the scammer agreed.

However, Carpenter said when she tried to take some money out of the Exodus wallet, the transfer kept bouncing back.

Things unravelled further when she called Exodus, and a staff member told her what she thought was $US150,000 was just a worthless token.

“He said, it’s not real money,” Carpenter said.

The Exodus staff member also identified 87 other transactions that had been made from the same Bendigo Bank account, suggesting the scammers were walking away with tens of millions of dollars from Australian victims.

When ANZ followed the matter up with Bendigo Bank, Carpenter was told the money was no longer there and had been moved overseas.

Devastated to learn the truth, Carpenter said she lodged multiple reports and complaints to Australian authorities, including the police and the Australian Financial Complaints Authority (AFCA) in a bid to get some justice, but they all led to dead ends.

Carpenter said she was appalled that Bendigo Bank had not detected the account was opened by a mule, and that the amount of money being sent overseas did not raise any red flags.

“For five months, hundreds of thousands of dollars was going through that account, disappearing overseas on a day-to-day basis, and nobody picked it up. Nobody. It just went on and on and on,” she said.

Carpenter said she was hoping to get in touch with other victims of the same scam in the hope of launching a class action against Bendigo Bank.

A spokesperson for Bendigo Bank said the bank could not comment on specific matters due to the privacy of its customers.

However, the bank was actively using proactive money mule detection measures including multi-factor identification, removing unexpected links in messages from the bank and a dedicated security team monitoring suspicious activity, the spokesperson said.

The bank had also tightened transaction rules blocking high-risk payments to cryptocurrency exchanges, the spokesperson added.

New scam-prevention laws pass parliament

Australians lose billions of dollars to scams each year, with reported financial losses to Scamwatch reaching $2.74 billion in 2023.

Investment scams like Carpenter’s accounted for almost half of those losses and are overwhelmingly the most common way victims are fleeced.

Today, new legislation was passed in parliament which will see banks and social media companies face fines of up to $50 million for failing to prevent scams.

The legislation was supported by the Coalition and described by Labor as the strongest anti-scammer protection in the world.

However, the new laws fall short of mandating compensation for victims, including only “redress mechanisms”.

The omission was criticised by consumer advocates and several independent MPs, including Monique Ryan and Allegra Spender, who would prefer Australia follow the UK’s lead of making banks solely responsible for protecting consumers.

Carpenter said the laws did not go far enough and would not help victims like herself.

The divorcee said she felt lucky she had not lost all of her money, as some people had, but she would soon be forced to take the drastic measure of moving overseas to make ends meet.

“I’m planning to leave the country and go to Ecuador because I can’t afford to live here, and I can’t rent or buy anything,” she said.