His death has been greatly exaggerated — twice.

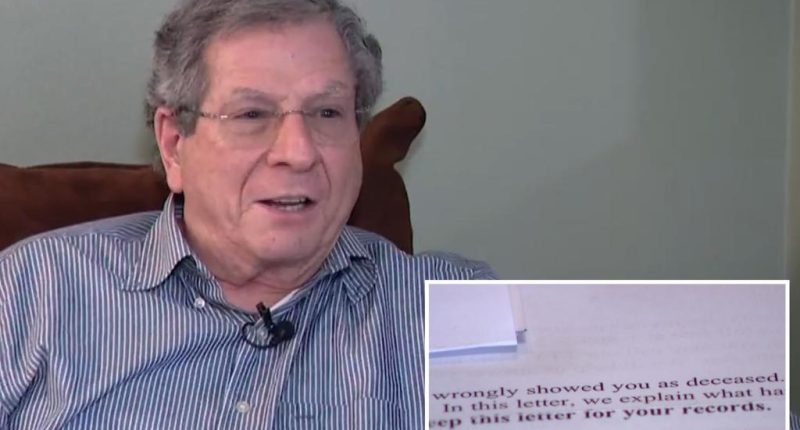

A Long Island widower discovered he was mistakenly declared dead – again – after he attempted to file his taxes leading up to the April 15 deadline, according to a report.

Gene Indenbaum’s battle with the federal government was reignited this tax season after his problems first started in 2022 when his wife suddenly died, News 12 Long Island reported this weekend.

At the time, the Social Security Administration erroneously marked him dead, too, leading to a myriad of headaches.

On top of social security, his health insurance, banking and credit cards were all thrown into disarray.

The problem was solved after the station first brought his conundrum to light in May 2024, but now it appears only temporarily.

When the Smithtown resident attempted to file his taxes electronically this year, his accountant called him while he was driving to let him know the IRS didn’t have documentation showing he was alive.

“I actually had to get off the road and stop,” he told News 12. “I was so upset.”

His recourse is to send a letter he previously received from Social Security confirming he’s still kicking.

While he hopes the issue is sorted out for the second time in two years, he left wondering how often he’ll be seemingly killed off on paper.

“There is no assurance at all,” Indenbaum told the station. “Luckily, I only have to file taxes once a year.”

Each federal screw up has brought back painful memories of his wife’s August 2022 death after the couple were married for nearly 50 years.

“For the person that’s going through this, it brought up all the grief that I had. We all make mistakes, but it’s not whether you make a mistake, it’s how you rectify the mistake,” Indenbaum said in the 2024 interview with News 12.