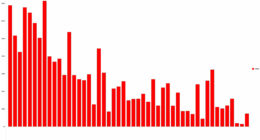

The alarming statistic, revealed by recent analysis, underscores the dire straits faced by small business owners in the state.

The construction and hospitality sectors have borne the brunt of these closures, accounting for nearly a third of the failed businesses.

The sectors, particularly vulnerable to economic fluctuations, have been severely impacted by high interest rates and reduced consumer spending.

Liberal Senator Dean Smith, who analysed the figures provided by the Australian Securities and Investments Commission, expressed concern over the personal toll insolvencies are taking.

“We know that many small businesses use their personal assets, their private homes to invest in their businesses,” he said.

“So when we see such a large number of insolvencies, many WA households and families are experiencing significant financial distress.”

Despite the recent interest rate cut, experts predict that the pain is far from over.

Insolvency numbers are expected to peak mid year, indicating a prolonged period of uncertainty for Western Australia’s business community.