The Barefoot Investor has blasted a proposal by the Coalition to ease lending rules to help Aussies buy a home, claiming it will only drive up property prices.

Scott Pape made the claim after concerned renter Penny wrote in to ask about the proposal that had been promoted by shadow housing minister Michael Sukkar.

‘I’m 32, a teacher, and renting with my boyfriend (also a teacher),’ she wrote.

‘We’re working hard and saving where we can, but the idea of owning a home in Melbourne still feels out of reach.

‘We don’t have rich parents or guarantors – my mum also rents, and my partner’s parents are still paying off their home.

‘I was doomscrolling property news and saw an article quoting…the Liberals’ plans to ease lending rules to help buyers without the Bank of Mum and Dad…does this mean anything for people like us, or is it just pre-election noise?’

Mr Sukkar revealed on Tuesday he would target the serviceability buffer on home loans if the Coalition came to power in the next federal election.

The financial regulator – the Australian Prudential Regulation Authority – requires banks to consider home loan applicants’ ability to service their mortgage at the current interest rate, plus an additional three per cent.

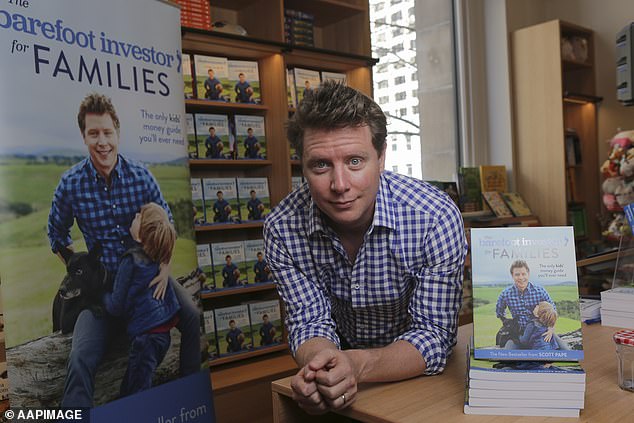

The Barefoot Investor has rubbished the Coalition’s plan to combat Australia’s house prices

The buffer was previously 2.5 per cent, before it was raised during the Covid pandemic.

The Barefoot Investor explained the buffer was a ‘stress-test’.

‘When you apply for a home loan, the bank checks if you can afford (the loan) even if interest rates go up,’ he wrote in his column for NewsCorp.

‘So if the rate is 6 per cent they test whether you could still make repayments at 9 per cent.

‘It’s called a “stress test” – and it’s there to stop people getting in over their heads if (or, let’s be honest, when) rates rise.

‘And, as a financial counsellor, I think it’s a thoroughly sensible police that keeps the screws on bankers.’

Mr Pape said Mr Sukkar saw it differently.

‘He argues that by lowering the buffer first home buyers would be able to borrow more. Which is true,’ he wrote.

Michael Sukkar announced he wanted to ease the serviceability buffer on home loans

‘But let’s think about it for, say, six seconds: Lowering the buffer would mean everyone could borrow more – so they would – and all that would do is drive up housing prices even further.

‘Sukkar’s plan is like eyeing off the last rubbery dim sim that’s been sitting in the servo steamer since last Sunday.

‘Penny, I know you’re hungry, but if you swallow what Sukkar is selling, well, just make sure you have a hazmat suit handy, a toilet roll in the freezer, and a plumber on standby.’

At the time of the announcement, Mr Sukkar said there was a systemic bias in favour of inherited wealth.

‘Right now, Australians without access to the “Bank of Mum and Dad” are punished by higher borrowing costs – even when the actual risk is the same or lower,’ he said.

‘That’s a systemic bias in favour of inherited wealth. We will remove it.

‘The Coalition will not accept a situation where a generation of Australians do not have the same opportunities for home ownership that previous generations have enjoyed.’