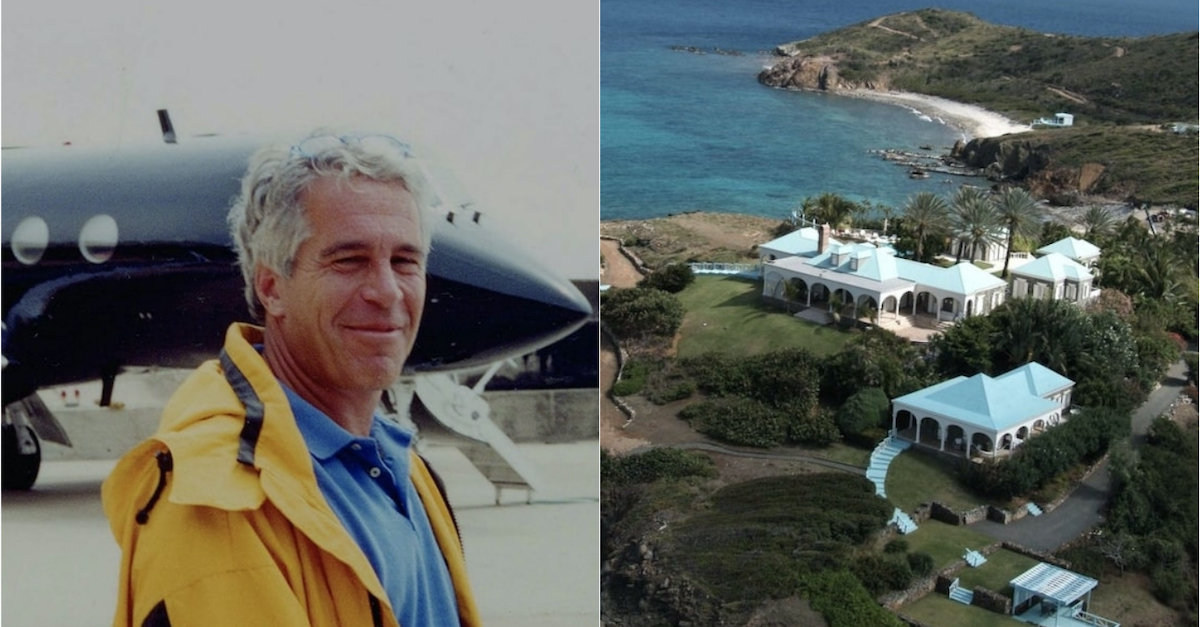

Jeffrey Epstein and his Virgin Islands home (Photos via DOJ)

A little more than a week after their $290 million deal became public, Jeffrey Epstein survivors released the terms of their proposed settlement with JPMorgan Chase to resolve their sex trafficking lawsuit. The fine print reveals some of the surprising ramifications of the agreement beyond the whopping, bottom-line figure.

Like many settlements of its kind, the Epstein survivors’ agreement does not force JPMorgan to admit to knowingly facilitating the sex offender’s crimes. That fact, while potentially disappointing to some, is neither unusual nor unexpected.

“That is standard operating procedure,” said former federal prosecutor Mitchell Epner, who led intake for sex trafficking cases in the District of New Jersey in the 2000s.

Other provisions of the 37-page page stipulation of settlement, however, emphasize the sweeping nature of this victory for the survivors, an expert tells Law&Crime.

Opt-outs

In class action lawsuits, settlement agreements often allow for survivors to opt out, potentially to advance their separate lawsuits. Such opt-out clauses often stipulate a minimum percentage of the class that have to opt-in for the settlement to be effective.

This one does not, leaving few constraints for survivors on their desired outcome.

“It’s a calculus that goes on about whether it makes sense to opt-in or opt-out because you can’t know in advance what your award will be because you can’t know how many people will be opting in,” said Epner, who is now a partner at Rottenberg Lipman Rich PC.

JPMorgan itself estimated that 137 people applied to the Epstein Victims Compensation Program (EVCP), but not all of them were allegedly abused by Epstein when he was a JPMorgan client: between 1998 and 2013.

The class period in the agreements spans between Jan. 1, 1998, through Epstein’s jailhouse death on Aug. 10, 2019, on the theory that the bank’s alleged failure to share what it knew with law enforcement enabled his abuse long after JPMorgan cut ties with their predator client.

Survivors are likely to find the settlement attractive, however: Beyond the large payout, the money would be separate from any they might receive from the EVCP, meaning collecting from it won’t affect that other compensation.

‘All in’

As a so-called “global settlement agreement,” the $290 million figure includes attorneys’ fees and the costs of administration. In Epner’s words, it’s “all in.”

“JPMorgan is done with whatever liability they’re going to have here,” he added.

The Epstein survivors have been represented by powerhouse attorneys who have been familiar figures throughout the saga, including David Boies, Sigrid McCawley and Brad Edwards. Collectively, they are seeking up to 30% of the settlement, plus expenses, charges and interest.

In their memo seeking court approval, Edwards wrote that such a request is “fair and reasonable” considering attorneys’ cuts in similar litigation and the successful outcome here.

“When placed in context of similar settlements and analyzed in light of the specific risks faced in this case, class counsel respectfully submits that the $290 million outcome was an excellent result,” he noted.

Read Related Also: Vietnam veteran allegedly shot wife to death, claimed he didn’t realize it was her

When factoring in a separate $75 million settlement the survivors reached with Deutsche Bank — which counted Epstein as a customer between 2013 and 2018 — the total pool adds up to roughly $365 million. The parties have requested that the same claims administrator agreed upon for the Deutsche case also steward the JPMorgan deal.

‘Any natural person who sexually abused them’

The settlement appears to contain a provision with seemingly broad language releasing employees, officers and entities associated with JPMorgan, either now, in the past, or in the future. But this clause has a significant exception.

“Nothing contained in this stipulation of settlement shall constitute a release of any class members’ claims against any natural person who sexually abused them,” the proposal reads.

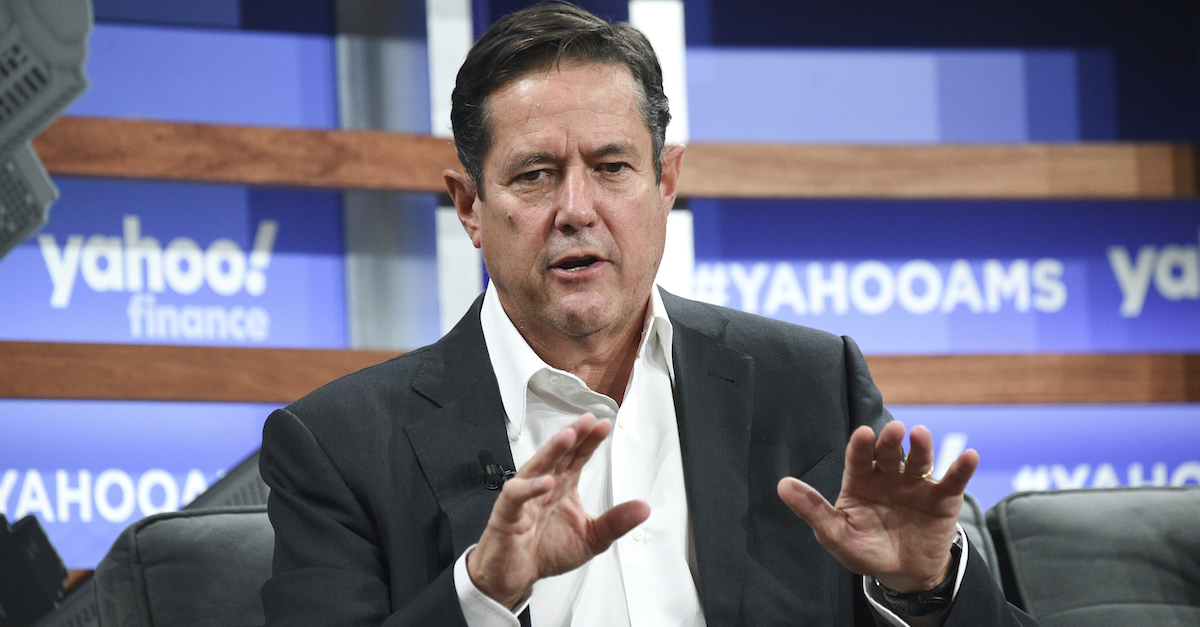

This potentially could be bad news for JPMorgan’s former senior executive Jes Staley, who once led their private and investment banking divisions and has been accused by the lead plaintiff of sexual assault. One court filing stated that Staley allegedly abused “some” Epstein victims.

Barclays CEO Jes Staley participates in the Yahoo Finance All Markets Summit at Union West on Oct. 10, 2019, in New York. (Photo by Evan Agostini/Invision/AP, File)

Amid the alarming allegations, JPMorgan filed a separate lawsuit against Staley, alleging that he “concealed his personal activities” with Epstein and calling for him to underwrite their potential liabilities. That lawsuit remains pending. So does another lawsuit that the Virgin Islands government filed against JPMorgan.

Staley’s representative did not respond to a request for comment. Staley has not been criminally charged.

Beyond Staley, the carve-out is significant because alleged Epstein enablers have long sought to benefit from the broad releases in settlement agreements. Deutsche, for example, cited a separate release provision to try to wriggle out of their lawsuit.

Next stop: Approval

Before it becomes effective, the proposed settlement will have to get a stamp of approval before Senior U.S. District Judge Jed Rakoff, a staunch critic of Wall Street after the 2008 financial crisis.

Famously, Rakoff initially rejected a deal that the Securities and Exchange Commission wanted to strike with Citibank because it didn’t force that bank to admit liability. There are several reasons that history likely won’t repeat itself here. For one, Rakoff’s ruling in the Citibank case was overruled by the Second Circuit.

More importantly, that deal involved federal regulators as opposed to private parties, and Epstein survivors benefit directly from this settlement for injuries they suffered, noted Epner.

The former prosecutor added that one reason liability admissions are uncommon has to do with the “perverse incentive” structure behind settlement approval hearings. In order to secure approval, the plaintiffs must persuade the judge that the settlement is a net-positive outcome over pressing the claims at trial.

JPMorgan admitting liability would be close to a concession that a trial against them would succeed, Epner noted.

In January, Judge Rakoff quickly approved a $26 million deal in a class action lawsuit against Deutsche Bank filed by shareholders over the German lender’s ties to Epstein and Russian oligarchs, and he’s widely expected to take the same course of action here.

The hearing is scheduled for Monday.

Have a tip we should know? [email protected]