Today NAB announced its standard variable home loan interest rate would increase by 0.25 per cent, effective from March 17.

On that same date, NAB will increase saving rates on several products by the same 0.25 per cent.

Similarly, Westpac informed customers that it was increasing home loan variable rates by 0.25 per cent for new and existing customers, effective from March 21.

Two savings products will also have the interest rate increased by 0.25 per cent.

Chris de Bruin, Chief Executive of Consumer and Business Banking at Westpac, said the bank understands the hardships successive interest rates are causing to the household budget.

”For home loan customers we understand after a number of successive interest rate rises some people are starting to cut back their spending to help balance the budget,” he said.

“We also realise there is a degree of uncertainty in the economic outlook and that is causing concern.

“While the majority of our customers are in a good position to absorb the impact of rising interest rates, we recognise cost of living pressures are challenging.

Read Related Also: Big bank unveils 'Australia-first' anti-scam technology

“We stand ready to support customers requesting hardship assistance at this time.”

Rachel Slade, NAB’s Group Executive of Personal Banking, said the bank also understood the impact rate rises could have on some customers.

“We know most of our customers are in good shape but, for some Australians, financial difficulty might be an entirely new experience as rising costs put increased pressure on their finances,” she said.

“Our support is designed to get our customers through the tough times, and we know that when our customers reach out to our NAB Assist team early for help, more than 95 per cent of them are back on their feet financially within three months.

“As rates increase so does the focus on savings and deposit products, so now is a great time to shop around and find the best rate and product features that work for you.”

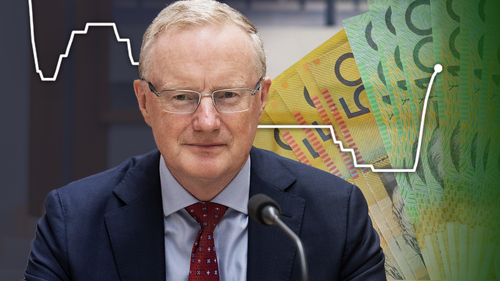

Tuesday’s rate hike by the RBA was the 10th consecutive time the central bank had increased the official cash rate in as many months, marking the fastest hiking cycle since the 1980s.

Australia’s cash rate target – colloquially known as the nation’s interest rate – is currently 3.6 per cent, the highest since May 2012.

‘Ultimate man cave’ for sale, with space for 12 cars plus bachelor pad